The International Monetary System: Why Gold Looks Like the Canary in the Goldmine

The Canary in the Goldmine

For centuries, the world’s dominant money tended to be backed by precious metals—and by the power of the leading empire of the day. Today’s system is different: the US dollar (USD) is the first truly global currency not tethered to gold or silver. Yet even now, when trust in the system is tested, one old signal still chirps: gold. World Gold Council

What’s driving the latest gold surge?

- Dollar dominance endures—barely challenged. The US still towers over global capital markets and the dollar remains used in about half of SWIFT cross-border payments. Alternatives (euro, renminbi, or a mooted BRICS currency) face structural or political roadblocks. In short: lots of talk, limited substitutes. World Gold Council

- Politics, not plumbing, is the real pressure. Sanctions, trade frictions and policy unpredictability have eroded confidence at the margins and pushed official and private buyers toward gold as a hedge. World Gold Council

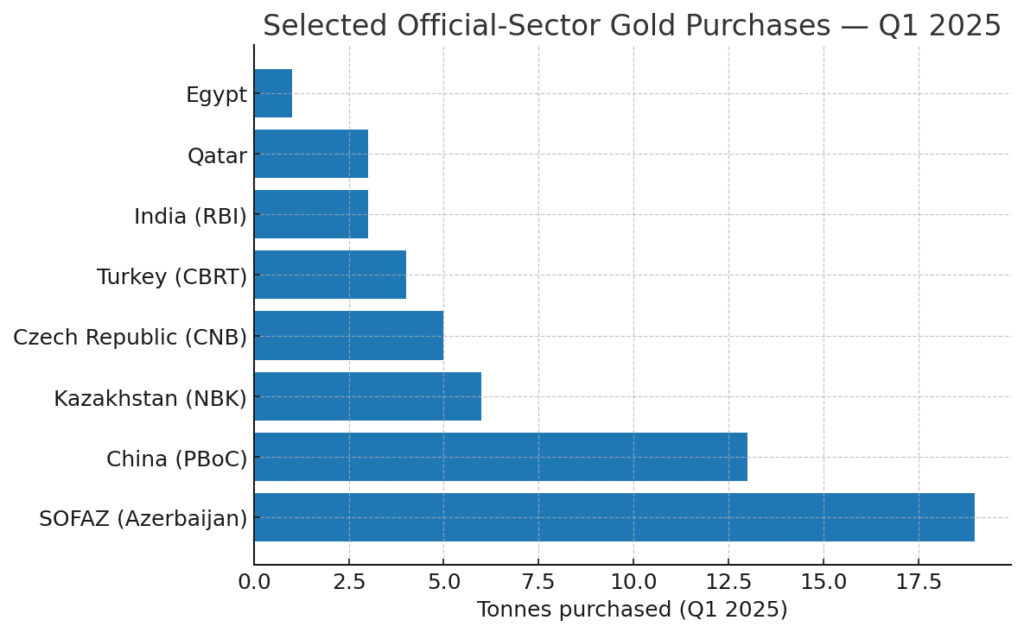

- Central banks are still buying. In Q1 2025, official-sector net purchases reached 244 tonnes, with notable buys from China (13t), Kazakhstan (6t), the Czech Republic (5t), Turkey (4t), India (3t), Qatar (3t), Egypt (1t) and Azerbaijan’s SOFAZ (19t). Poland’s NBP was the largest buyer that quarter. World Gold Council+1

The big idea

Gold’s price has historically spiked when trust in US policy or the global rules of the game weakens. The World Gold Council argues today’s move could be an early signal of a gradual shift from a US-centric system toward a more multipolar one—not a return to a gold standard, but a world where gold’s role as a neutral reserve asset matters more. World Gold CouncilIAI

Charts you can embed

1) Selected official-sector gold purchases, Q1 2025

(Data from WGC’s Gold Demand Trends Q1 2025 page; only countries with explicit tonnage in the source are charted.)

2) USD share of SWIFT cross-border payments (approx., June 2025)

(Visualizing the article’s “about half” point; shown as a simple 50/50 split to avoid fabricating finer detail.)

Key takeaways for readers

- Dollar first, no clear second. Market depth and legal/institutional infrastructure keep the USD on top—for now. World Gold Council

- Policy shocks funnel demand to gold. Sanctions use, tariff noise, and geopolitical strains have made gold attractive to both central banks and investors. World Gold Council

- A long transition, not an overnight reset. Expect incremental diversification (including into gold) rather than a sudden replacement for the dollar. World Gold Council

Sources

- World Gold Council — The International Monetary System and the Canary in the Goldmine (Aug 19, 2025). World Gold Council

- World Gold Council — Gold Demand Trends Q1 2025: Central Banks (published 2025; figures to Mar 31, 2025). World Gold Council